ProVeg International has partnered with Innova Market Insights to bring you a webinar which explores the key trends of the past year in the plant-based sector and the predictions for the year ahead. Read on to learn more about consumer behaviours when it comes to plant-based purchasing, as well as some of the key barriers experienced. Harness Innova’s top trend predictions for 2023 and be the first to meet consumer needs while boosting your bottom line.

Innova is a global market intelligence company that uses technology and research to help businesses make data-driven decisions. Utilising Innova’s exclusive data and insights, Myrthe de Beukelaar, Senior Market Analyst at Innova Market Insights, uses the key trends of the past year to predict where the food-and-beverage industry is headed in 2023. Some of the predicted trends for the year ahead include ‘Quick Quality’ and ‘Plant-Based: Unlocking a New Narrative’, with the plant-based sector reflecting post-pandemic behaviour changes in consumers.

Full recording:

Where we’ve been: what is driving the food-and-beverage industry?

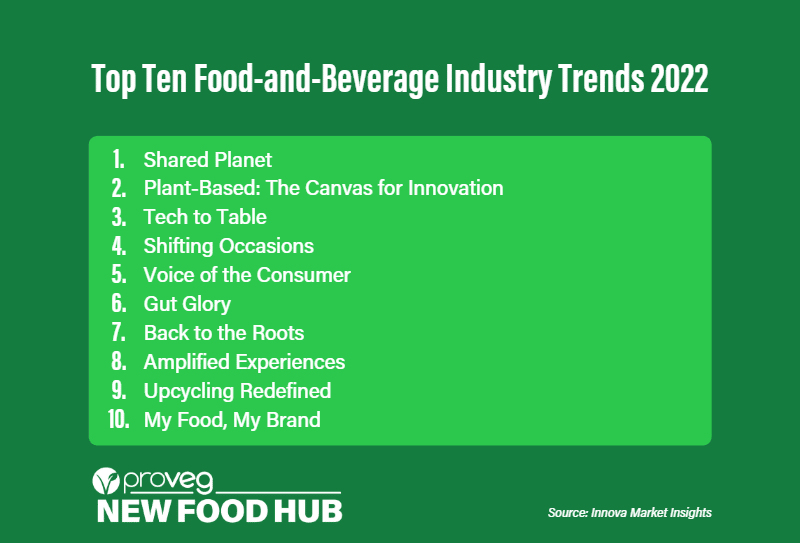

To forecast the future and plan ahead, we first need to look into the past. Kickstarting the webinar, De Beukelaar walks us through Innova’s Top Ten Trends of 2022.

Innova’s top ten food-and-beverage industry trends for 2022

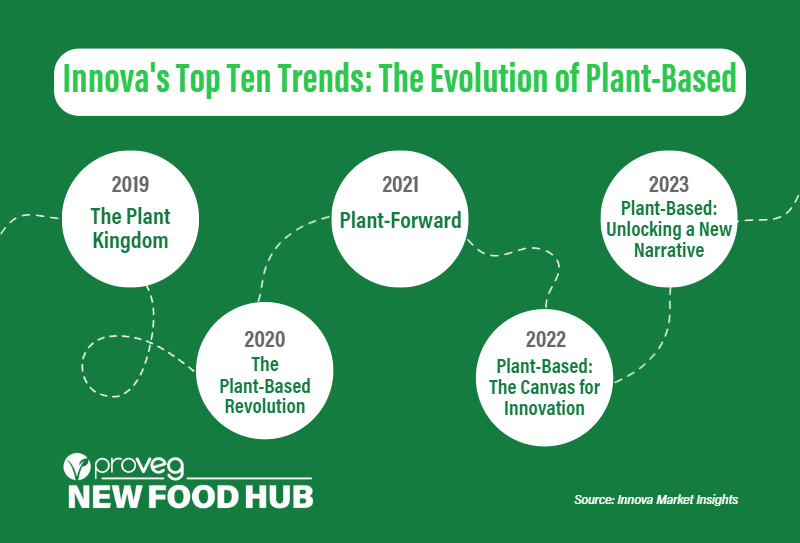

‘Plant-Based: The Canvas for Innovation’ ranked as the second highest trend in the food-and-beverage industry in 2022, and health also remained a key driver for consumer behaviour within the industry in both 2021 and 2022. However, De Beukelaar is keen to highlight that there are wider forces at work, including post-pandemic consumer needs and the desire to consume sustainably. Often, communication regarding health benefits ties into the idea of a healthy planet and a brand’s sustainability efforts.

“There is also a need for [the plant-based industry] to increase its relevance by satisfying the diversity of consumer demands,” says De Beukelaar, pointing to the wealth of innovation seen in the sector in 2022.

She gives the example of WunderEggs plant-based boiled egg product launch, as well as Miyoko’s Creamery vegan mozzarella product, with its melting and bubbling qualities. Innovation also expanded in more indulgent categories such as chocolate, with the success of Cadbury’s plant-based bar.

Texas-based startup Crafty Counter announced the world’s first plant-based boiled egg in 2022.

Offering something different to consumers became central in the past year, notes De Beukelaar, with premium and indulgent products gaining ground in the plant-based space. According to Innova’s data, food and beverages launched with both a plant-based and indulgent claim saw year-on-year growth of 44%.1 Beyond just retail, the indulgent plant-based category is also making strides in food-service businesses, particularly in restaurants. “It’s a force pushing plant-based forward on the menu,” says De Beukelaar, highlighting how fine-dining restaurant Eleven Madison Park in New York retained its three Michelin stars after its transition to becoming fully plant-based.

If you’re interested in learning more about the growth of plant-based indulgence and its combination with health, make sure to check out our last webinar with Innova, ‘A healthier way to indulge? How to position plant-based foods to maximise their appeal’, available here on the ProVeg New Food Hub.

Other trends which featured in 2022 included ‘Back to the Roots’, homing in on cleaner labels with a holistic focus, as well as ‘Shifting Occasions’, which addressed evolving modes of consumption post-pandemic.

Oisix ra daichi is used as a key case study of these two trends coming together, with the Japanese company offering consumers a food-subscription, home-delivery service with a focus on farm-to-table and food security. The company also has another string to its bow, with ‘Upcycled by Oisix’ offering products made from upcycled ingredients, such as banana-peel jam. “It’s an interesting way to mainstream upcycled food,” comments De Beukelaar.

Oisix’s upcycled banana-peel jam a-peels to a range of consumer desires.

Where we’re going: the landscape for 2023

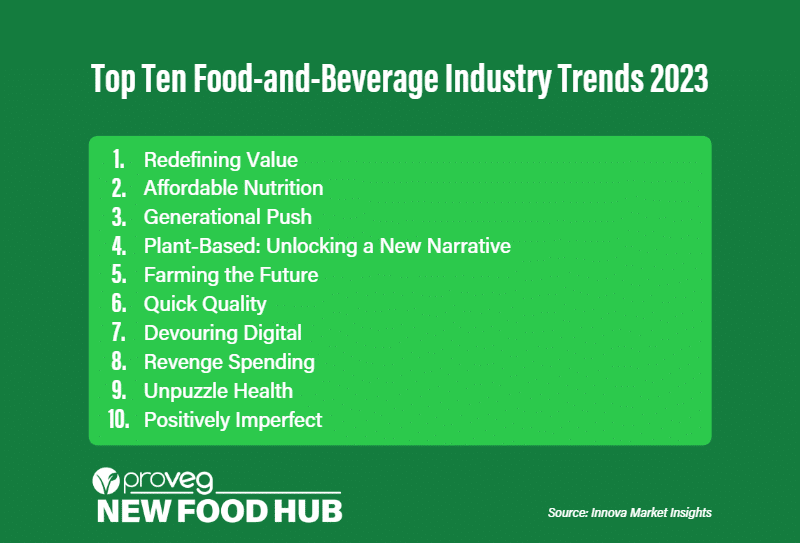

Amongst the trends identified for 2023, ‘Plant-Based: Unlocking a New Narrative’ stands as one of the most influential for the industry. After some plant-based categories stuttered in the face of unexpected global challenges – such as the war in Ukraine and detrimental climate events – the plant-based sector has come under intensified scrutiny.

Innova’s top ten food-and-beverage industry trends for 2023

“The plant-based sector has risen so rapidly over the past few years, it’s almost inevitable that it will hit some roadblocks at some point,” admits De Beukelaar. “But the global market value and volume of meat substitutes are still growing.”

There are many success stories and huge interest in [the plant-based industry] remains.”

Having asked consumers directly, Innova’s insight draws attention to the range of desires plant-based shoppers would like to see met, going into the future. Centrally, consumers are searching for improvements in taste, texture, and flavour. Aside from this, De Beukelaar underscores, there is an increasing demand for products which don’t just mimic meat and dairy, but provide unique value as a standalone offering – such as tofu or tempeh.

“Standalone products have risen in our recent popularity rankings to third place, rising above the demand for better imitation meat and dairy products, which is now in sixth place,” explains De Beukelaar.

With regard to meat-alternative technologies, she discusses how consumers are increasingly wanting enhanced product taste (36%), enhanced nutritional value (31%), improved digestibility (25%), and lower environmental impact (24%). Surprisingly, mimicking traditional animal-based meat textures only comes in at 21%, demonstrating the salience of improving standalone meat-alternative products. Opportunities in this space are rife, De Beukelaar suggests, drawing our attention to the newly founded Fungi Protein Association, which seeks to expand research in the fermented mycoprotein space.

Other predicted trends include increased regionality in food-and-beverage offerings, while ‘Quick Quality’ is another trend that brings together indulgence and gastronomy themes into 2023, much like ‘Amplified Experiences’ did in 2022.

“Culinary creativity blossomed in the pandemic,” De Beukelaar elaborates. “Businesses now need to combine this more with convenience to accompany people’s busier routines.”

Moreover, according to Innova’s insights, two-thirds of consumers globally agree that they are searching for simple and convenient ways to ensure their nutrient intake. Satisfying this niche of convenience, nutrition, and indulgence is thus a key task for brands in the coming year. “It’s about giving consumers control over their food and helping them to create something to be proud of,” De Beukelaar continues.

Here, she draws our attention to the French frozen food company Picard, which developed the ‘Mix & Miam’ concept. The idea allows consumers to combine different elements of their frozen range together to create a customisable meal option at an affordable price, thus combining pressing price concerns with convenience, consumer control, and culinary flair.

Picard’s Mix & Miam concept invites consumers to customise ingredients to design their ideal dish, all at a low cost.

Other subcategories with plant-based claims which have seen strong growth going into 2023 include chocolates blocks (+175%), sandwich fillers and spreads (+194%), and meal kits (+347%). Once again, De Beukelaar accentuates the link to convenience for the consumer alongside control and creativity in the kitchen. If you are interested in reading more about how best to target flexitarians within the meal-kit and recipe-box subcategory, make sure to read our full article here on the ProVeg New Food Hub.

Looking to the future, De Beukelaar provides us with some key learnings from the 2023 trend predictions.

One such learning is the increasing relevance and influence of younger consumers, particularly ‘Gen Z’ consumers.

“Gen Z and Millennials have a strong voice and will make the difference, especially in the standalone space,” De Beukelaar notes. “They are extremely responsive to engagement from brands.”

Aside from this, companies must remember to develop plant-based food offerings with the senses in mind and, centrally, at an affordable price. Considering the current cost-of-living crisis affecting many throughout the world, this point cannot be over-emphasised.

Cost-of-living crisis and consumer spending cuts: how to maximise value

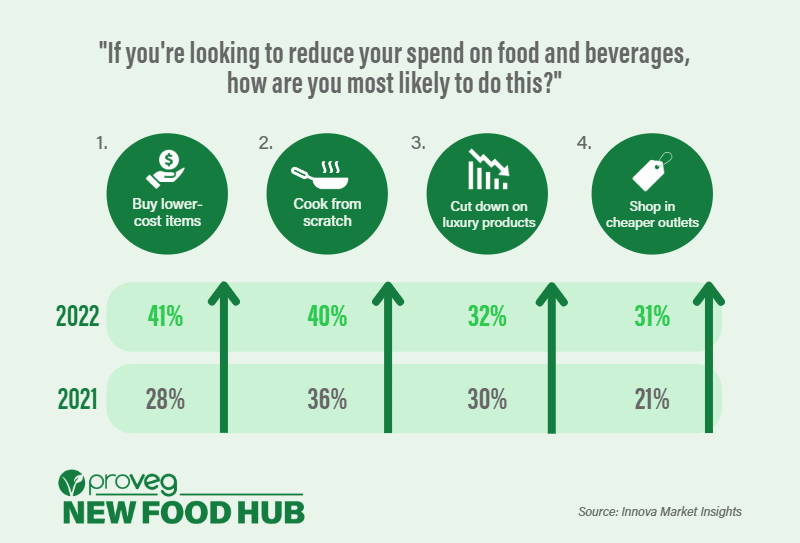

According to Innova’s trend survey, cheaper prices will remain a key driver into the coming year, while consumers will be increasingly committed to reducing spending. Innova’s data furthermore cites an 86% year-on-year growth rate for food-and-beverage launches that feature a budget claim.2

“There has been a shift from last year to this year on how consumers are reducing spending in the food-and-beverage sector,” De Beukelaar explains, noting how buying lower-cost items has taken over from cooking from scratch as the number one way consumers reduce spending. “This provides an opportunity for private label ranges, however.”

Cutting down on luxury products became the third most common way in which consumers reduced spending in 2022, meaning brands will have to work even harder to justify premium pricing. As such, brands will need to promote value for money and provide consumers with an array of benefits. Other forms of value beyond cost include a product’s freshness, its functionality, its ability to boost health, and whether or not it has been locally produced. To highlight these value points, it’s essential to know your consumer, and to use storytelling to communicate the benefits of your product effectively.

Consumers seek out brands that respond more to their core values, purchasing products that have value beyond just cost.”

Linking to the second-highest trend for 2023, ‘Affordable Nutrition’, innovation within the plant-based space should focus on making essential nutrition viable for as many people as possible. This aligns with the opinions of consumers, who believe that new food-and-beverage products should be driven by both health and affordability.

Q&A

What are some best-practice examples of the shift towards unique, standalone products in the plant-based sector?

De Beukelaar notes that you can already see this trend towards standalone plant-based products developing within the food-service space, with chefs playing a major role in using plant-based ingredients to create new dishes that excite the senses.

“This will also be seen in retail, with the expansion of chef-inspired products and ranges,” she continues. “In our database, we see more and more products that feature a ‘chef-made’ or ‘chef-inspired’ claim on packaging.”

As well as ‘Unlocking a New Narrative’, such developments also lend themselves to the ‘Quick Quality’ trend, where consumers seek out products that help them to add a convenient and creative flair to their cooking.

What is the projected growth pattern of the plant-based sector looking like as a whole?

In response to this question, De Beukelaar emphasises that it is impossible to generalise the plant-based sector as a monolith. “It all depends on which format and subcategory you look at,” she says. “It also depends on the region.”

Europe, for example, is seeing more expansion into segments such as meal kits and fish alternatives, compared to Asia, which is seeing greater plant-based expansion in the ready-meal category.

“There will still be lots of investments in the space,” she confirms. “The slowdown we’ve seen reported in the media has not been seen in every category.”

For more on this, click here to read ProVeg’s full response to the recent misleading claims that the plant-based sector is in irreversible decline.

Considering the higher cost of many plant-based options, is it likely that flexitarians will revert back to cheaper animal-based products?

De Beukelaar acknowledges that this is a definite risk considering the current economic climate and draws on her own experience as a flexitarian. Achieving price parity is one of the clearest ways to mitigate this risk. If you’d like to learn more about how your company can achieve price parity with animal-based products, check out our article on the ProVeg New Food Hub website, or watch a recording of our October webinar, ‘Price parity as a driver of plant-based sales’.

Which categories and products are becoming less popular?

While Innova tracks the categories and trends that are picking up steam, it is trickier to tell which are losing favour. “It’s difficult to tell when you’re only looking at product launches,” says De Beukelaar. “Fewer product launches doesn’t necessarily mean something isn’t popular amongst consumers.”

Driving growth and popularity among unfamiliar products comes down to storytelling, she says. Consumers often prefer the familiar protein types, such as chickpea or potato. To highlight more unfamiliar food types, brands should focus on communicating the uses and value of their alternative products.

How and why did Innova choose the countries used in the trends survey?

Innova’s trends survey combines an average of results from Brazil, China, France, Germany, India, Indonesia, Mexico, Spain, the UK, and the US. These countries were chosen by Innova for their capacity to represent larger regions.

“It’s not possible to include all the countries in the world,” De Beukelaar says. “Instead, per region, we select some of the countries which we feel are good representatives of trends.”

Innova has a variety of other surveys conducted on an annual basis that include even more countries, such as their category survey, where a wide range of respondents are required to ensure the robustness of their results.

Is plant-based here to stay, or is it just a passing fad?

For De Beukelaar, it all comes back to how you position your plant-based product on the market, which claims you use to do this, and which story you are trying to tell. When considering the longevity of the plant-based sector, it’s all about going back to the needs of your target consumers, and making sure to redefine the value of your product to them. If plant-based products remain valuable to the consumer, the category will remain steadfast.

According to the trends, consumers are looking for healthy products combined with indulgence. However, consumers still want indulgence in non-health categories, such as baked goods. What can we take away from this?

According to Innova’s insight, healthy, indulgent offerings have exploded within the plant-based sector. However, this does not necessarily mean indulgent categories such as baked goods or confectionery need to re-think their offerings.

“It’s about responding to what your consumer is looking for,” says De Beukelaar. “Most are looking for something truly indulgent, something that gives them a break from reality. In these cases, it’s not about the combination of health and indulgence, but rather about the occasion and tapping into this.”

When it comes to the truly indulgent categories, it’s about responding to what your consumer is looking for.”

What are your thoughts on the ‘Amplified Experiences’ trend converging with the idea that consumers are looking to cut back on luxury items?

While the ‘Amplified Experiences’ trend featured as the eighth top trend of 2022, De Beukelaar points out its absence from the 2023 trend predictions.

“This [‘Amplified Experiences’] trend has transformed into the ‘Revenge Spending’ trend post-Covid,” she notes. “Revenge spending is for those consumers who are usually price conscious, but who are looking for a short-term, immediate experience of indulgence.”

These one-time, often impulsive forms of spending stand in sharp relief to the purse-string tightening caused by the current cost-of-living crisis affecting many across the globe.

Even as consumers reduce their spending, Innova predicts a rise in the ‘Revenge Spending’ phenomenon.

Key takeaways

For the plant-based industry, Innova’s insights point us in the direction of a ‘New Narrative’. Having moved beyond the era of simply using technology to best mimic animal-based meat and dairy products, consumers now expect to see unique, standalone plant-based products on the shelf that provide them with a variety of values and benefits.

Defining and providing value for the consumer is essential in the current economic climate, and this will be the key challenge for brands promoting their products in the coming year. While price parity with animal-based products is the desired end goal for many in the industry, providing consumers with alternative benefits will instead have to play a central role in the short term. The growing consumer desire for ‘Quick Quality’ and ‘Revenge Spending’ will see convenience and indulgence increasing in popularity throughout the coming year, providing brands with more opportunities to add value to their products. At the same time, in the post-pandemic landscape, many of these added values will come from added health claims: ranging from personal, and nutritional health, to the health of our planet as a whole.

If you would like to stay on top of all of the plant-based trends and innovations going into 2023, you can find weekly informative content on ProVeg International’s New Food Hub website. If you would like to find out more about Innova’s consumer insights and trend surveys, you can reach out at [email protected], or visit their website here.

Don’t waste any time in finding out all the ways you can accelerate your company’s transition to net zero, increase your profits, and help to build a better world!