Over the past six months, ProVeg International has been using its innovative New Food Hub platform to share content that contains practical and implementable advice for those interested in succeeding in the plant-based arena.

With the end of the year looming, now is the perfect time to look back over the last six months of content and highlight the top actionable insights that the New Food Hub has shared.

These insights will uncover what consumers want when it comes to plant-based products, how best to target your audience, and ultimately, how to increase your sales and market share.

Let’s get stuck in.

1. Shift your marketing focus to flexitarians

One of the biggest decisions that plant-based brands must make when starting out, is who they are going to target their products towards. Now, you might be thinking that a plant-based brand should target a specifically plant-based audience. But this is not entirely the case.

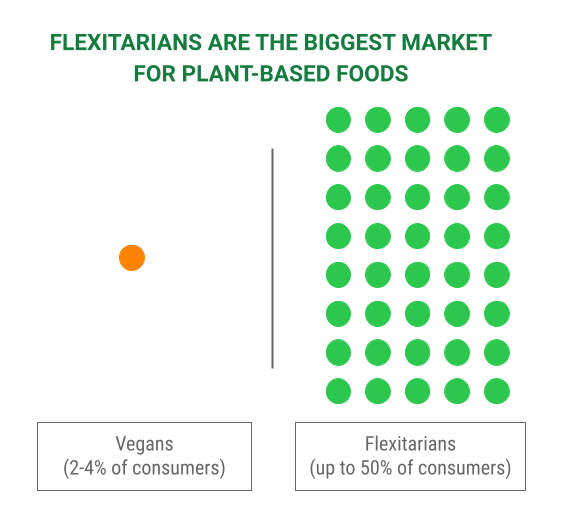

A recent pan-European Union (EU) survey led by ProVeg International found that vegans represent less than 4% of total addressable consumers. But when you include vegetarians, pescetarians, and flexitarians, the group in total represents about 40% of the population – meaning that over a third of all Europeans no longer view themselves as predominantly meat-eaters.1 Of this percentage, a staggering 30% identify as flexitarian, meaning that they eat plant-based products several times a week, but also consume meat and dairy products.

If you were to target only those consumers who follow a vegan lifestyle, then you would not actually be targeting the largest consumer group interested in purchasing plant-based products – flexitarians!

ProVeg Tips

ProVeg has extensive knowledge of flexitarian consumers in Europe, from general preferences to specific consumer sentiments regarding particular product categories. We regularly help retailers and brands with their plant-based merchandising, educational social media, and product development. Get in touch with us at [email protected].

Research shows that 70% of Beyond Meat’s consumers are flexitarians and that nine out of 10 American consumers who purchase plant-based milk also purchase dairy milk.2

So, by shifting your marketing focus from vegans to flexitarians, you could unlock a total addressable market that is over 10 times larger! It makes sense, then, to channel your marketing efforts towards this demographic in order to maximise sales.

Take away:

- Tailor your marketing focus to flexitarians – this means packaging, advertising campaigns, product location, and merchandising should all be designed to attract flexitarian consumers.

- Research your target market thoroughly to make sure that you understand their motivations for purchasing PB foods and their preferences, to ensure you are giving them what they want and need.

You can read our detailed article on flexitarian consumers here.

2. Emphasise taste, familiarity, convenience, and health on packaging

In a recent study conducted by ProVeg as part of the Smart Protein Project, we asked flexitarians across 11 European countries about the most important factors when choosing a plant-based food product. The results show that taste and health are two of the most significant purchase drivers – around 2,000 of the 7,500 flexitarians that were surveyed stated that it is important to them that the plant-based food products they choose are tasty and healthy.3

The success of products such as the Beyond Burger and the Impossible Burger shows that consumers want a familiar, craveable experience that’s healthier, more eco-friendly, and animal-free. Food familiarity is key for flexitarians – they might eat a plant-based burger one night and an animal-based burger the next night.4

Always think about targeting the flexitarian consumer by creating delicious and familiar products that they crave, and showcasing these plant-based menu items with indulgent descriptions integrated seamlessly into the main section of the menu.

To target flexitarians, use inclusive artwork that emphasises traditional values and benefits. This is especially important for analogue products such as plant-based sausages or cheeses. For instance, nostalgic images of sunny fields or a photo of a smiling grandmother are great ways to connect your new plant-based product to a consumer’s previous positive experiences.

Don’t cover your packaging with images of activists and rescue animals. It’s off-putting to your broader target market. As food entrepreneur Heather Mills puts it: “Don’t worry about what vegans like – they will always find you!”5

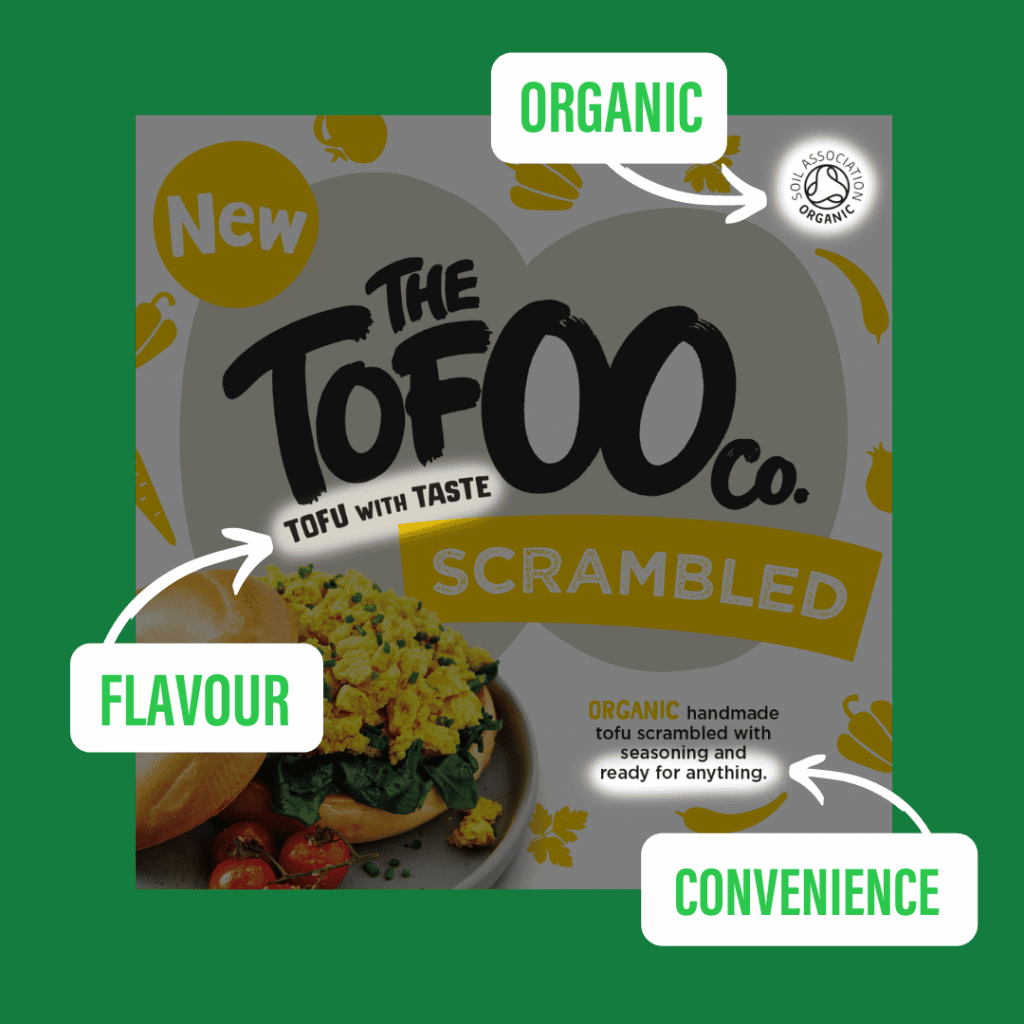

Flexitarians are looking for taste, convenience, and health (in that order). They don’t want to feel like they’re missing out, so focus on indulgence.

The Tofoo Co.’s Scrambled Tofu packaging covers all three of the top criteria for flexitarian shoppers. The packaging artwork subtly features accompanying vegetable items that complement the product. The strapline ‘scrambled’ is accompanied by a photo of the end product, showing buyers that it’s easy to use. This is further reinforced by the description, which tells you it’s pre-scrambled and pre-seasoned. Short of literally spoon-feeding their consumer the meal, they’ve nailed it. This is a product designed with convenience, flavour, and health in one.

Take away:

- Make sure that your product packaging emphasises taste, health, and convenience. Can consumers tell from your packaging that the product is tasty and healthy? Can consumers see what your product is and how to use it from the packaging? Is it easy to prepare?

- Don’t cover your packaging in images of activists and animals – it’s off-putting to your broader target audience.

3. Use ‘plant-based’ on the front and V-label on the back

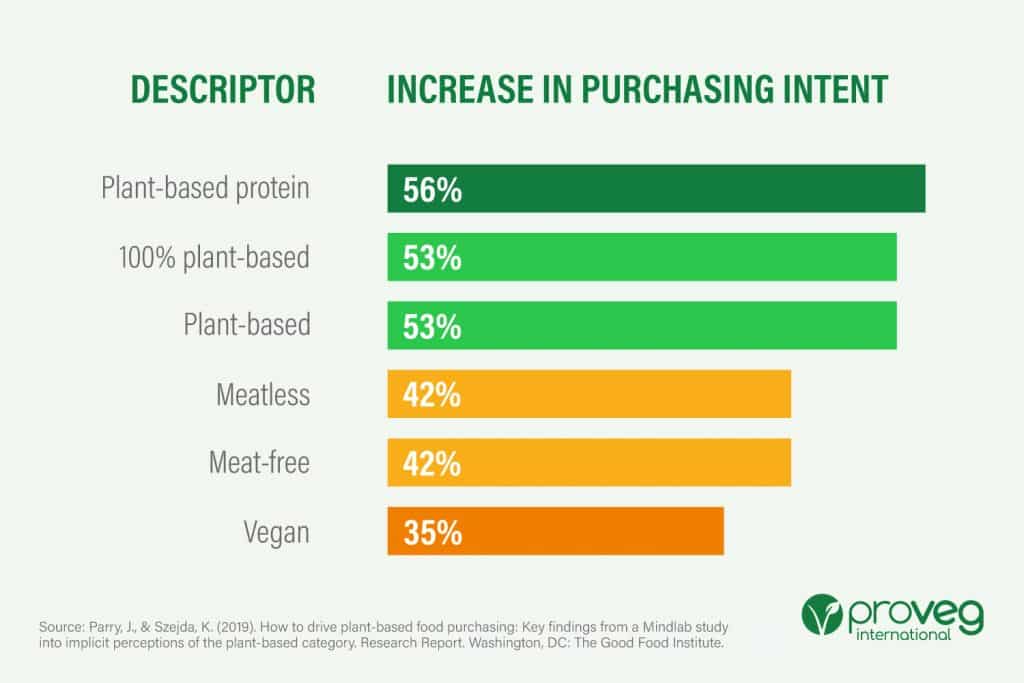

Word choice is vital when designing packaging for plant-based products – restrictive language can be off putting, while certain terminology can attract purchasers.

ProVeg recommends opting for the word ‘plant-based’ on front-of-product packaging, with a V-label certification on the back – this combination will maximise your products’ appeal to flexitarians.

But, why not use the word ‘vegan’ on your front-of-packaging?

While ‘vegan’ is generally better understood by flexitarians in native English-speaking countries, as illustrated by a survey carried out by ProVeg,6 using the word on product packaging results in the lowest increase in purchasing intent.

Research by the Good Food Institute found that variants of the label ‘plant-based’ increased mainstream consumer purchasing intent by around 20% compared to the label ‘vegan’.7

With no formal legal definition in the UK or EU regarding a vegan or plant-based product, this is perhaps an underlying cause of consumer confusion, as the two terms tend to be used interchangeably. That’s why it’s important that products get V-label certification, as it’s the most reliable way to give consumers seeking 100% animal-free products confidence that they might otherwise lack based on terminology alone.

We learned earlier that flexitarians value indulgence, so ProVeg recommends avoiding restrictive language such as ‘meat-free’ and rather opting for ‘100% plant-based protein’ on the front of pack, with a V-label certification on the back to best appeal to the flexitarian consumer.

Take away:

- Use the word ‘plant-based’ on the front of your plant-based product packaging.

- Display the V-label on the back of your plant-based product packaging.

- Avoid restrictive language and images.

To learn more about front-of-pack messaging, read this article, and to find out more about getting a V-label, click here.

4. Highlight the sustainability of your product

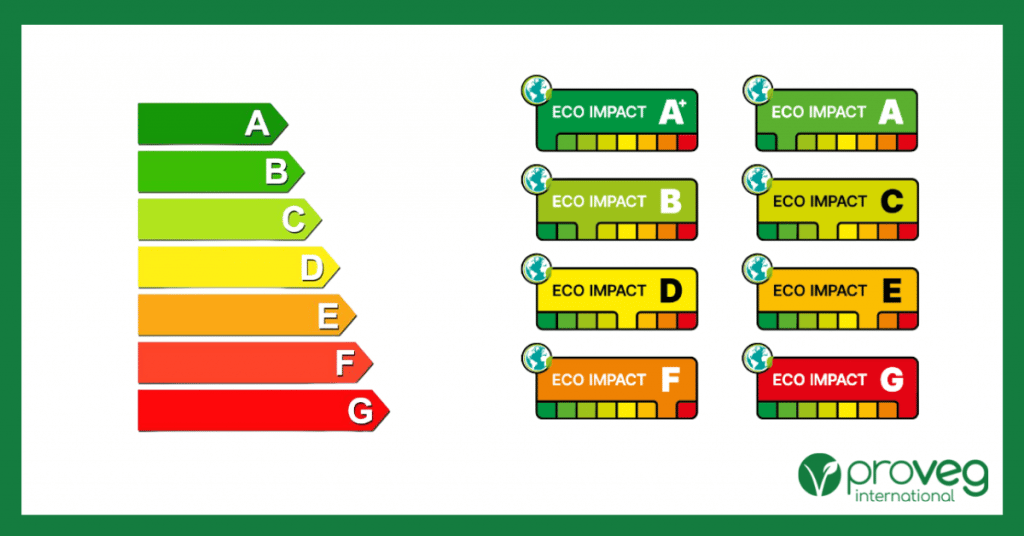

Environmental impact is becoming increasingly important to consumers. A Pan-EU survey run by ProVeg International as part of the Smart Protein Project, found that 62% of European consumers want their food to be environmentally sustainable. These findings are in line with Forbes research which revealed that 65% of modern consumers are seeking brands and products that are socially and environmentally responsible.

Globally, about 49% of consumers are aware that plant-based alternatives are better for the environment, so an ecolabel or similar environmental-impact labelling can help your brand to stand out from the crowd and signal to sustainability-conscious flexitarian consumers that your product is environmentally friendly.8

Environmental-impact labelling is a way for brands to communicate their product’s eco-credentials to consumers – typically via front-of-pack messaging. There’s currently no one international standard, so it’s up to brands to choose their preferred method. But the best thing you can do is make your label easy for consumers to understand – choose a single metric that is intuitively colour-coded.

To make it credible, use a trusted third party to certify your environmental impact or emissions claims.

Take away:

- Add an environmental-impact label onto your product packaging so that consumers understand how sustainable your product is.

- Apply for official accreditation to gain trust of your consumers.

5. Prioritise earned media over paid partnerships

Word-of-mouth is the most powerful marketing tool. 92% of consumers believe recommendations from friends, family, and influencers over all other forms of advertising.9

According to McKinsey, word of mouth is responsible for up to 50% of purchase decisions.10 It leverages the innate human desire to connect with people we trust and be part of a chosen ‘in-group’. Influencers combine trusted word-of-mouth with scale of reach. They’re like your high-school cool kids — popular, fun, and powerful allies.

Working with influencers who are aligned with your brand’s values can play a critical role in effectively marketing your products, and if done correctly, can encourage a wider consumer base to become aware of and interested in purchasing your products.

There is lots of evidence to suggest that influencer marketing can grow your brand’s audience and market share more than conventional social-media advertising.

Research shows that Millennials and Gen-Z consumers trust influencers twice as much as they trust friends and family for recommendations. Almost half of Gen Z has made a purchase decision based on a recommendation from a social influencer.11

Almost 90% of marketers find influencer marketing delivers a return on investment (ROI) that is either comparable to or better than other marketing channels. Influencer marketing can deliver an average ROI of $5.20 for every $1 spent.12

What is ‘earned media’?

’Earned media’ is any content that mentions your brand but which was not paid for or promoted through advertising and did not come from your own media channel. It’s one of the ways that influencers can generate real value for your brand.

By selecting influencers who align with your brand values you can build incredible relationships with them, so much so that they want to support your brand, without any monetary compensation.

Impossible Foods has a ‘hard policy’ when it comes to influencers: they won’t pay them a penny. It’s not about avoiding the ‘#ad’ declaration rules, but rather about seeking a higher quality of relationship with the influencers they choose to work with.

It’s the same reason that almost 50% of marketing professionals believe that posts tagged with #ad will actually perform worse than non-sponsored posts.13 The basic idea here is that ‘earned media’ exposure is more powerful than paid promotion. And that stacks up when you look at Impossible Foods’ growth – they achieved sales of $1.4bn in 2020.14

When Impossible Foods launched their Burger 2.0 at CES 2019, they knew it would bring a concentration of influencers to a place where they could easily taste the new product. They didn’t pay for influencer time but instead offered them an in-person tasting experience. The event generated 446-million media mentions for Impossible, totalling more than $4m of ad-value equivalence.15

As you can see, earned media offers opportunities for both audience expansion and increased revenue.

Take away:

- Build relationships with influencers who are aligned with your brand values and have a flexitarian following. Satisfy the right influencers’ taste buds and you can win over thousands of other target diners.

- Don’t pay influencers upfront. Instead, offer them free products to try. Your goal is for them to share their incredible tasting experience with their followers, and thus grow your audience.

For a detailed guide on this topic, check out our guide: How to work with influencers to reach key consumers.

6. Focus on taste marketing

As we saw earlier, taste is a primary motivator when it comes to plant-based food purchases. The good news for brands is that many plant-based foods are super tasty! The bad news is that not all consumers know this yet. So, aside from using alluring packaging, how do you get a flexitarian consumer to taste your product before they purchase it?

The answer is: through taste marketing.

Free food, cooked well, attracts new consumers. Multiple studies have found that the majority of consumers (~75%) who receive freebies go on to remember the brand name and hold a positive association with that company.16 It also lowers the barrier to repurchasing.

A great way to raise your profile is by going direct to wherever your target consumers are – and feeding them in situ.

In June 2021 vegan seafood brand Good Catch pulled off an audacious publicity stunt. Capitalising on raised public awareness of overfishing following the release of the documentary Seaspiracy, the brand parked food trucks outside Subways in New York, Texas, and London. They offered passers-by free tuna subs that contained their Good Catch filling.

The stunt raised consumer awareness of the Good Catch brand internationally and helped the company to secure a partnership with Long John Silver’s the following month. This created a great opportunity for consumers to try their products in a familiar setting, and drove repurchasing behaviour to grow the brand’s early-stage direct-to-consumer platform.

.

Food trucks are a great investment (whether you own or hire one) – assuming you pick a high-footfall location.

Another proactive option, is for retailers to encourage potential customers to try their plant-based products through the use of sample stations. Just like food trucks, taster counters allow consumers to try tasty pre-cooked plant-based products without forking out beforehand.

By allowing flexitarian consumers to taste your products before they purchase them, you can increase your brand awareness, build trust with new consumers, and ultimately drive more sales.

Take away:

- Create opportunities for consumers to try your products for free; for example, with food trucks or sample stations in retail stores.

For more information on why taste marketing works to increase sales, click here.

7. Promote plant-based products next to animal-based products in-store and online

The location of plant-based products in stores and online really affects customer pick-up-and-purchase rates. Where and how you position them on a shelf and in which aisle or online category really matters. With animal-based products still dominating supermarket shelves and e-commerce sites, and with location in mind, how can we give a fair chance to plant-based items? It’s simple: by grouping them next to or near their conventional counterparts on shelves and on websites.

The reason that (full or partial) integrated merchandising works to increase sales is because it puts plant-based products in front of the largest consumer audience: flexitarians, who, as we discovered in point one, are responsible for the majority of purchases of plant-based alternatives.

At ProVeg, we recommend utilising what’s known as an ‘integrated-segregated’ approach, whereby plant-based products are grouped together but positioned within animal-based-product aisles. This merchandising technique, which takes plant-based products to where the most potential shoppers are, can boost sales and aid sustainability, while still allowing vegans to access their favourite products.

Category managers may worry that vegan consumers will struggle to find their favourite products if integrated-segregated aisles are created, yet vegan consumers will seek out plant-based food and drink no matter where these products are located. On the other hand, flexitarians and mixed eaters are less likely to venture into separate plant-based aisles. This is because, by grouping plant-based products in a ‘vegan’ aisle, you group them as ‘only for vegan consumers’ and not for flexitarians and reducetarians. Unsurprisingly, when asked what would help them choose healthier and more sustainable options, like plant-based meats, while shopping, 57% of consumers agreed that stocking meat-free products in the animal-based meat aisle would help.17

In 2021, US supermarket giant Kroger explored this concept with an experiment that ran across its stores. While some locations maintained separate plant-based and animal-based product aisles, other locations integrated these two aisles. The study found that integrating plant-based alternatives into conventional-meat aisles increased sales of plant-based products by 23%.18

Julie Emmett, Senior Director of Retail Partnerships at the Plant Based Foods Association, who helped Kroger with the study, commented on the research: “This proves that it is important for retailers to place plant-based meat where shoppers expect to find it: in the meat department.”19

Kroger even experienced an increase in sales in traditionally meat-heavy US areas, like the Midwest. Emmett added: “The increase in sales in the Midwest demonstrates there is a tremendous opportunity for plant-based meats to succeed everywhere, including in the nation’s heartland.”20

All it takes is the right merchandising!

Take away:

- Build a new way of working where X number of product slots in an animal-based category are reserved for vegan products, and integrate placement.

- Increase the visibility of plant-based products to encourage purchases. This doesn’t require additional shelf space. Simply position plant-based products at the end/start of aisles, at store entrances, and near check-out points.

Read more about how merchandising techniques can drive your plant-based sales by reading our in-depth article, here.

Conclusion

Over the last six months, ProVeg International has shared the following insights which, if applied, can help retailers and brands to increase their plant-based product sales:

- Shift marketing focus to flexitarians

- Emphasise taste, familiarity, convenience and health on packaging

- Use ‘plant-based’ on the front of packaging and V-label on the back

- Highlight the sustainability of plant-based products

- Prioritise earned media over paid-for influencer marketing

- Focus on taste marketing

- Promote plant-based products next to animal-based ones

If you’re looking to learn how to attract more customers and instigate a greater number of plant-based purchases, ProVeg can help. Get in touch to talk over and develop your plant-based strategy by emailing us at [email protected].

References

- Smart Protein Project (2021): What consumers want: a survey on European consumer attitudes towards plant-based foods, with a focus on flexitarians’, European Union’s Horizon 2020 research and innovation programme (No 862957). Available at: https://smartproteinproject.eu/consumer-attitudes-plant-based-food-report/ Accessed 2022-10-19.

- The Good Food Institute: Plant-Based: The Business Case. Available at: http://goodfoodscorecard.org/why-plant-based/#I1 Accessed 2022-10-19.

- ProVeg International (2020): European consumer survey on plant-based foods. Available at: https://proveg.com/what-we-do/corporate-engagement/proveg-consumer-survey-report-download// Accessed: 2022-10-19.

- The Good Food Institute: Plant-Based: The Business Case. Available at: http://goodfoodscorecard.org/why-plant-based/#I1 Accessed 2022-10-19.

- Mills quoted at Plant-Based World Expo, London, October 2021.

- Smart Protein Project (2021): What consumers want: a survey on European consumer attitudes towards plant-based foods, with a focus on flexitarians’, European Union’s Horizon 2020 research and innovation programme (No 862957). Available at: https://smartproteinproject.eu/consumer-attitudes-plant-based-food-report/. Accessed 2022-10-24.

- Parry, J, & Szejda, K. (2019). How to drive plant-based food purchases: Key findings from a Mindlab study into implicit perceptions of the plant-based category. Research Report, Washington DC: The Good Food Institute. Accessed 2022-10-18.

- Smart Protein Project (2021): What consumers want: a survey on European consumer attitudes towards plant-based foods, with a focus on flexitarians’, European Union’s Horizon 2020 research and innovation programme (No 862957). Available at: https://smartproteinproject.eu/consumer-attitudes-plant-based-food-report/. Accessed 2022-10-17.

- Nielsen (2012): Consumer trust in online, social and mobile advertising grows. Available at https://www.nielsen.com/us/en/insights/article/2012/consumer-trust-in-online-social-and-mobile-advertising-grows/. Accessed 2022-10-17.

- Bughin, J; Doogan, J; Vetvik O J (2010): A new way to measure word-of-mouth marketing. McKinsey. Available at https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/a-new-way-to-measure-word-of-mouth-marketing. Accessed 2022-10-24.

- Geometry Global, cited in Brouwer, B (2017): Study: Consumers trust influencers 94% more than friends or family when making shopping decisions. Medium. Available at: https://medium.com/@breebrouwer/study-consumers-trust-influencers-16-more-than-friends-or-family-when-making-shopping-decisions-1e3c7d20c98a. Accessed 2022-10-24.

- The Influencer Marketing Hub; Viral Nation; NeoReach (2019) cited from Santora, J (2021):100 Influencer marketing statistics for 2021. Influencer Marketing Hub. Available at https://influencermarketinghub.com/influencer-marketing-statistics/ (last accessed 11.10.2021).

- Social Publi (2020): Influencer marketing: what’s working in 2020. Available at: https://socialpubli.com/blog/2020-influencer-marketing-report-a-marketers-perspective/ (last accessed 21.10.2021).

- Poinski, M (2021): Impossible Foods preparing to go public with $10B valuation, Reuters reports. Food Dive. Available at https://www.fooddive.com/news/impossible-foods-preparing-to-go-public-with-10b-valuation-reuters-report/598083/ (last accessed 21.10.2021).

- Consumer Technology Association (n.y.): Impossible foods. Available at https://www.ces.tech/Exhibitors/Success-Stories/Impossible-Foods.aspx (last accessed 21.20.2021).

- ASI and Identity Works cited in Wood, M. (2017): Branded Giveaways And Other Promotional Products: Do They Still Have An Impact? Available at: https://www.forbes.com/sites/allbusiness/2017/12/14/branded-giveaways-and-other-promotional-products-do-they-still-have-an-impact/?sh=66c893ae7790 Accessed 2022-10-24.

- Segregation or integration – Ranging plant-based products to drive sales (2021). Available at: https://www.igd.com/articles/article-viewer/t/segregation-or-integration-ranging-plant-based-products-to-drive-sales/i/27924 Accessed 2022-10-18.

- Plant-Based Meat Sales Increase An Average of 23% When Sold in the Meat Department (2020). Plant-Based Foods Association. Available at: https://www.plantbasedfoods.org/plant-based-meat-sales-increase-an-average-of-23-when-sold-in-the-meat-department Accessed 2022-10-18.

- Plant-Based Meat Sales Increase An Average of 23% When Sold in the Meat Department (2020). Plant-Based Foods Association. Available at: https://www.plantbasedfoods.org/plant-based-meat-sales-increase-an-average-of-23-when-sold-in-the-meat-department Accessed 2022-10-18.

- Plant-Based Meat Sales Increase An Average of 23% When Sold in the Meat Department (2020). Plant-Based Foods Association. Available at: https://www.plantbasedfoods.org/plant-based-meat-sales-increase-an-average-of-23-when-sold-in-the-meat-department Accessed 2022-10-18.