Here’s a riddle for you. What tastes great and can generate revenue, but isn’t reaching consumers? Spoiler: it’s the plant-based products you’re mis-marketing. Read on to discover the most common marketing mistakes plant-based manufacturers make – and what you can do instead.

Executive Summary

For your plant-based product to thrive nationally and internationally you need to:

- Emphasise indulgence (flavour and taste), convenience, and health (not the environment)

- Target flexitarians (not vegans)

- Be price competitive with meat in the long-term

- Translate your labels and ingredients properly and with regional sensitivity (stickers are off-putting)

- Know your target culture

1. Environment matters but is it really number one?

Most people love the environment but currently only a minority actually change their shopping behaviour because of it. Most people are concerned about the environment but currently only a minority actually change their shopping behaviour because of it. The environment is typically of greatest concern to Gen Zs and Alphas, who don’t yet have much spending power.

So what about everyone else? Well, according to one of Europe’s leading food manufacturers, “The sad reality is that 90% of consumers just don’t care about packaging or environmental concerns – when it comes to it, they want convenience.” Oof. That’s a bleak summary. But is it true? Er…kind of.

Numerous studies have found that the eNumerous studies have found that the environment does matter to consumers… but not as much as other things.123 This means that if you’re trying to reach mainstream shoppers, you need to prioritise other messages.

For consumers in the West, the key motivations for consuming plant-based products are:4

- Taste and convenience

- Health

- Other

The ‘other’ category includes consumers who are motivated by the environment, animal welfare, religious diets, and trying to impress someone on a first date. Valid as those perspectives may be, they’re not the ones to target.

If you want to gain market share, your packaging and marketing materials need to promote imagery and wording that aligns with the 80%, not the 20%.

If you’re looking for some support in refining your product’s positioning, branding, and communications in order to meet the specific needs of your target market, ProVeg has got your back. Check out our corporate services.

2. Target the flexitarians

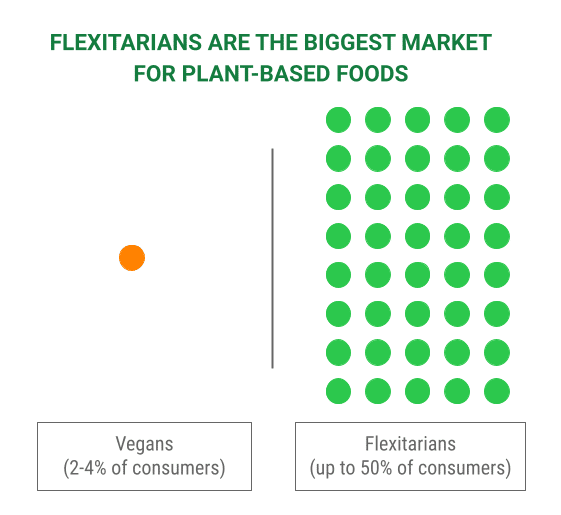

A recent pan-EU survey led by ProVeg International found that almost 40% of EU consumers now identify as either flexitarian, vegetarian, pescatarian, or vegan, while In Germany, over 50% of consumers identify as flexitarian.5 A similar trend is evident in the US, where almost half of Americans regularly purchase both dairy and plant-based milk during their weekly shop.6

In contrast, vegans represent less than 4% of total addressable consumers.

By shifting your marketing focus from vegans to flexitarians, you could unlock a total addressable market that is up to 11 times larger!

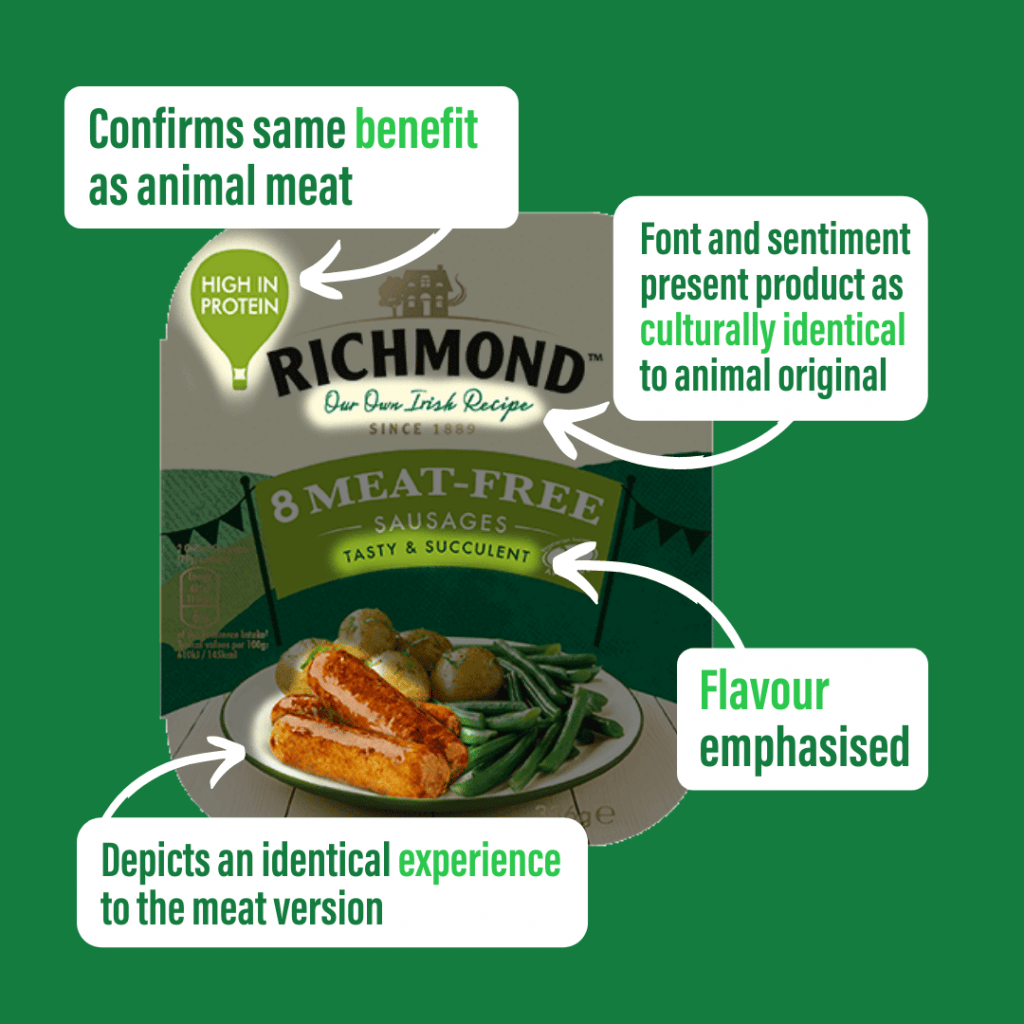

In order to target flexitarians, use inclusive artwork that emphasises traditional values and benefits. This is especially important for analogue products such as plant-based sausages or cheeses. For instance, nostalgic images of sunny fields or a photo of a smiling grandmother can be great ways to connect your new plant-based product to a consumer’s previous positive experiences.

“Marketing plays a key role in consumer acceptance,” explains Jeanine Ammann, Research Associate at Agroscope. “To reach flexitarian consumers, it’s better to promote a vegetarian dish as tasty instead of highlighting that it is vegetarian.”

Check out our case studies below for some examples of best practice.

Case Study – Aldi Poland promotes plant-based diets

Aldi Poland wanted to increase their plant-based range and raise awareness of the new products. In 2021, they partnered with ProVeg Poland to devise a campaign aimed at promoting the benefits of a plant-based diet.

ProVeg supported Aldi with tailored messaging, crafted to resonate with mainstream shoppers. We also helped them to build four educational campaigns and “action weeks”, which were conducted in-store and online.

ProVeg designed the first campaign to raise awareness of the health benefits of key vegan alternatives. The “healthy plant-based plate” initiative launched Aldi Poland’s awareness activities. ProVeg created recipes consisting of plant-based products available in all Aldi stores during the promotion. The campaign was a huge success with consumers and earned positive mentions for Aldi across food-industry media.

If your business is ready to take its plant-based retail strategy to the next level,

ProVeg is here to help. Get in touch at [email protected].

3. Don’t price products too high

Vegans pay a high price for their values. Much of that is due to inflated retailer margins (40% on some plant-based products vs 8% on some animal meats, according to major European food producer of both animal and plant-based proteins). But producer margins matter too. A team effort is needed in order to negotiate retail price points that mass-market customers find attractive. Why bother? Because the potential reward is huge.

According to one European retail giant, vegans account for just 2% of its customers but 20% of revenue. At first glance, that sounds like they’re onto a lucrative winner. But when you look at the total addressable market that they’re not addressing, you see that their strategy is actually limiting overall revenue.

The bigger opportunity is to achieve a higher-volume of low-margin sales. By lowering your prices, you can win over flexitarians and significantly increase your overall profits. Are you seeing the plant-based dollar signs yet? Let’s compare the two strategies side by side to really illustrate the opportunity here.

Revenue Example: Targeting Vegans vs Flexitarians

The example below shows the revenues that a food producer could expect on plant-based burger patties that they sell to supermarkets for €1.

Let’s say that 1,000 average consumers go to a supermarket. You can expect 4% to be vegan, and 40% to be flexitarian (when you include the vegans, vegetarians, and pescatarians). Even with drastically lower margins, you can see from the table below that the high-volume flexitarian market has the potential to drive two-and-a-half times more profit.

| Manufacturer price per unit | Manufacturer revenue per unit | Total addressable market | Profit per 1,000 average customers | ||

|---|---|---|---|---|---|

| Vegans | High margin (30%) | €1 | €0.30 | 4% of shoppers | = €12 profit |

| Flexitarians | Low margin (7%) | €1 | €0.07 | 40% of shoppers | = €28 profit |

The benefits of appealing to flexitarians are plain to see. Mainstream consumers are time-poor and overloaded with decision fatigue. Price is their number-one motivator and the best way to get their attention.

Long-term price deals are vital

Flexitarian consumers need long-term price deals in order to embrace plant-based alternatives. This was the verdict of one of Europe’s leading plant-based food producers in a private interview with ProVeg. We investigated their claim and found other studies that have reached the same conclusion. Even for consumers who want to make ethical choices, price is still the main obstacle.7

Customers need to see a new product at low prices for at least six months. That allows for the repeated exposure needed to generate regular sales. Food producers need to work with retailers in order to achieve this kind of long-term promotional offering and consequently grow their reach.

The best way to help consumers embrace new routines is to offer a discount so they can experience it for a lower price. If the taste is good, then they’re more likely to maintain that new routine.”

Fortunately, retailers are increasingly keen to explore these opportunities. For instance, the Dutch supermarket chain Coop partners with Vivera every year for their ‘Week Without Meat’ campaign, whereby they offer all Vivera products for just one euro. Similarly, Carrefour Belgium offers a 10% discount on their plant-based ranges every Monday as part of their ‘Meat Free Mondays’ campaign.

Both retailers have found that longer-term price incentives work – brands should be making the most of this opportunity to increase volume and reach.

It gets better: both retailers and manufacturers have found that flexitarians are ‘sticky’ customers – once they develop a taste for a new product category, it becomes habitual.8 This loyalty even crosses categories (e.g. if flexitarians develop a taste for oat milk, they’ll likely become fans of oat ice cream too).

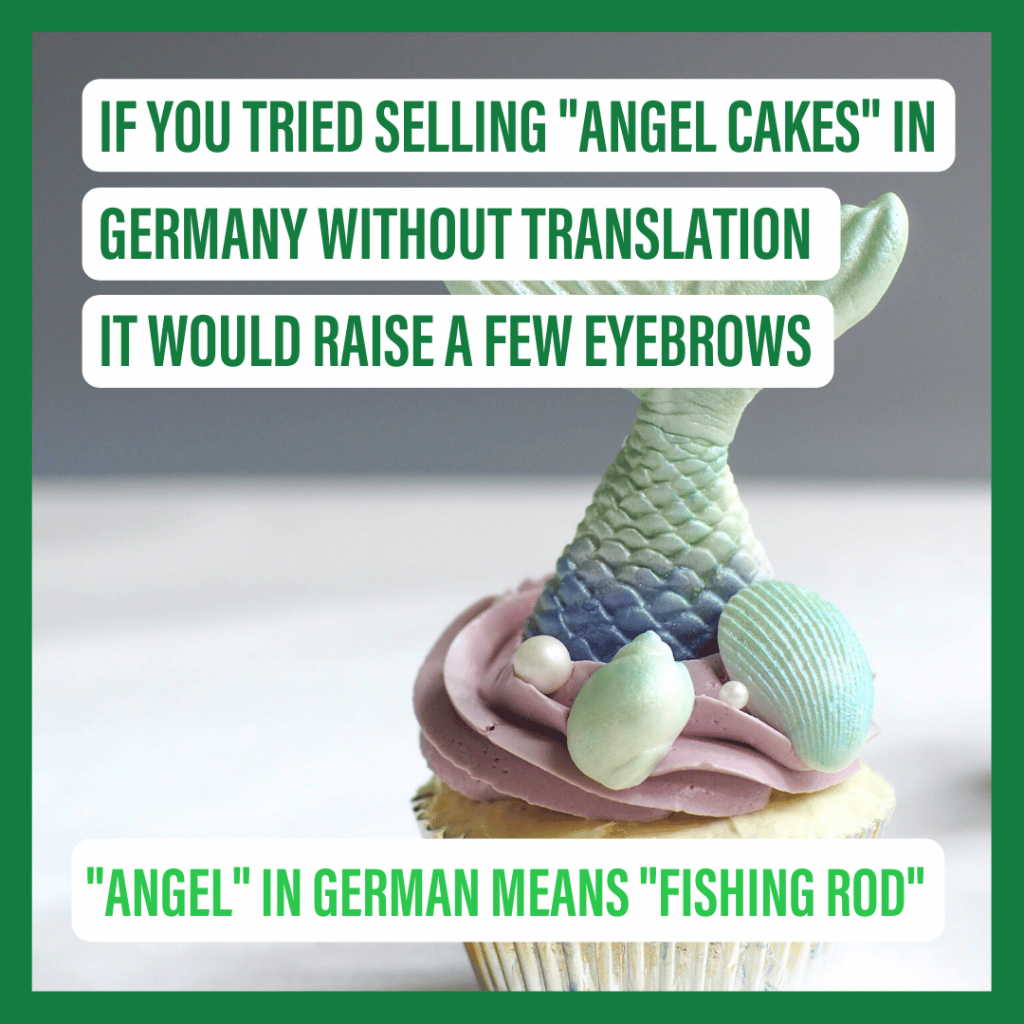

4. Don’t cut corners with regional language

Don’t fall into the sticker trap. When brands are rushing into a new market, they can be tempted to cut corners and use translation stickers. These are often small, hard-to-read, and badly positioned. A token nod to labelling laws doesn’t make your packaging attractive to consumers.

People like ease and familiarity. There’s no point in creating the tastiest product in the world if you then hide it behind a foreign language. People simply won’t try it – as one of our case studies will demonstrate later…

At ProVeg, we operate across 10 countries and speak more than 20 languages, making us uniquely positioned to support your products, both locally and internationally. Let’s work together: [email protected].

5. Culture is key

Consumers need to feel culturally embraced. That doesn’t mean your fermented Norwegian plant-based Rakfisk should pretend it’s an almond croissant. This is about recognising the tipping point between exotic and alienating. It’s not enough to simply translate your original marketing materials.

For instance, when KFC launched in mainland China, they translated their branding verbatim. Unfortunately, their idiomatic slogan didn’t quite resonate with Chinese culture. Over there, good finger-licking is something cannibals and zombies do – and they probably make up less than 1% of KFC’s target market! Are you seeing the opportunity cost?

The language translation is easy, but the culture is more difficult. It’s why we have a dedicated person for community building in each target country.

We’re local experts. Work with us to take your product to market successfully: [email protected].

Product Messaging: Examples of Best Practice

As mentioned above, the three key motivators for consumers (aside from price) are taste, convenience, and health. Let’s take a look at how to nail each of those key messages.

Taste

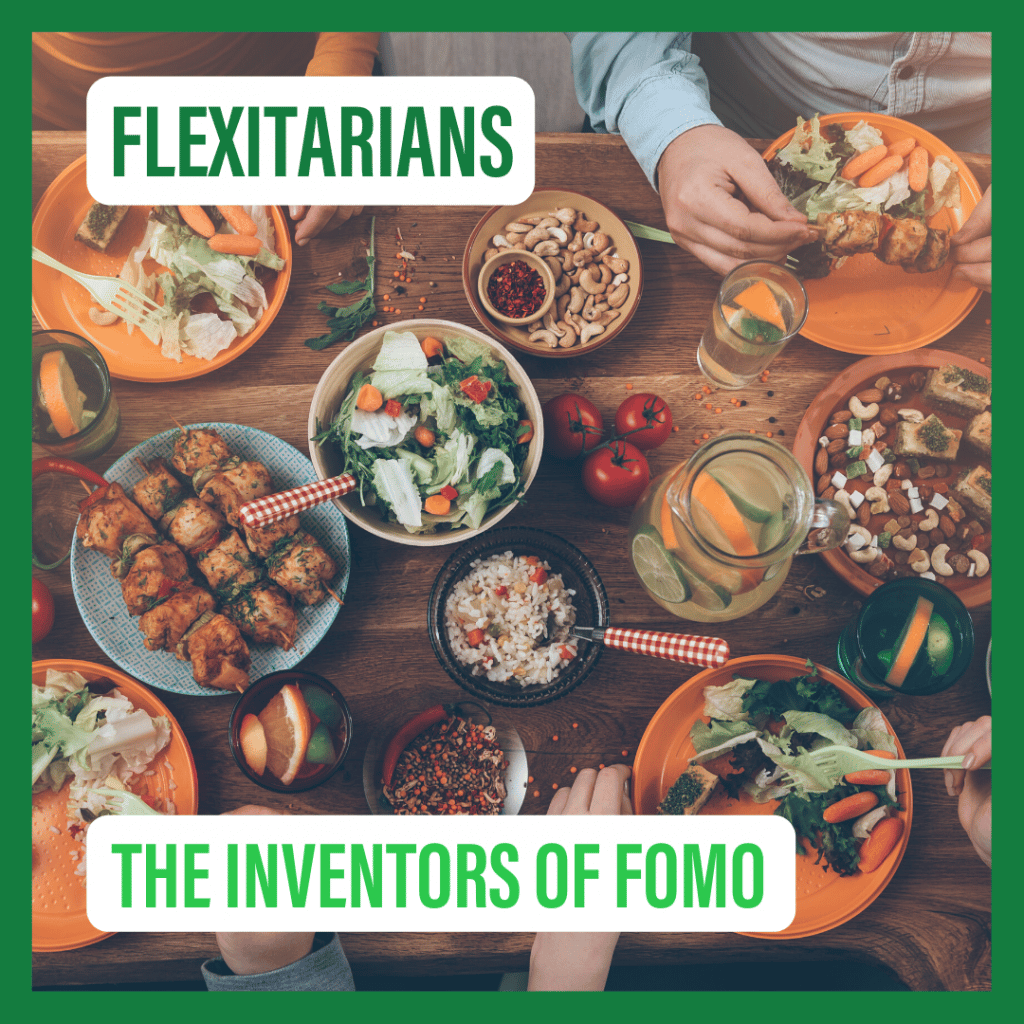

You’re selling a tasty, sensory indulgence. Your words need to appeal to people’s hedonistic impulses.

Tell them about the sensory experience they’ll have – e.g. creamy, nutty, silky, with a light note of caramel, fresh

Remember, you’re battling flexitarian FOMO (fear of missing out). It’s super important to counter this with positive messaging about the taste benefits of plant-based food.

We won’t be telling anyone to give anything up… [we want to] entice people.

Product | Indulgence advertised |

|---|---|

| Oggs Chocolate Fudge Cupcakes | “Everybody loves ‘em” “Fantastically fudgy delights” |

| Good Hemp Creamy Seed Drink | “Light and Tasty” |

| Magnum Vegan Classic | “Velvety vanilla flavoured indulgence dipped in sweet Belgian chocolate” “Plant based indulgence” |

| Hellmann’s Vegan Mayo | “Same great taste” |

Convenience

Big brands recognise the importance of convenience for consumers. Your packaging needs to reflect this but so do elements such as cooking instructions and on-pack recipes.

“Our new campaign is to stop thinking about Quorn as an alternative and start thinking about it as good food that fits people’s lifestyles.”

Peter Harrison, Marketing Director at Quorn9

Here are some great examples of convenience-based marketing:

Product | Convenience advertised |

|---|---|

| Quorn Makes Amazing Peri-Peri Strips | “Fry me!” badge Strong serving suggestion image |

| Just Wholefoods Vanilla Custard Powder | “Use any milk” (front) Clear prep instructions (back) |

| Holy Cow! Delhi Tikka Masala | “Home cooked curry made easy” Serves two |

| Wahaca Sweet and Smoky Taco Fajita Kit | 2 people 10 minutes |

Health

Fun fact: 70% of flexitarian consumers seek plant-based foods for health reasons (mainly to increase vegetable intake).10

However, our FOMO-prone friends may be concerned that nutrients prevalent in meat are lacking in plant-based products – particularly B12, iron, iodine, and calcium.

“Flexitarians are particularly concerned with ensuring their diet is balanced”

Susie Stanard, Consumer Insight Manager, Agriculture and Horticulture Development Board (UK)11

In order to compete with animal-based meat, plant-based products need to emphasise key nutritional qualities such as protein content. These may also include qualities that animal-based meat doesn’t have – such as high fibre to aid digestion.

Here are some top health-based marketing examples:

Product | Nutritional benefits advertised | |

|---|---|---|

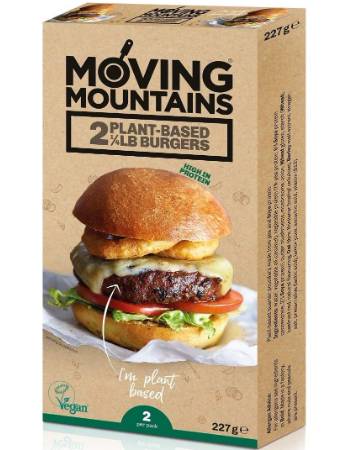

| Moving Mountains Burger |  | 100% RDA of B12 in each burger No GMO No hormones Zero cholesterol |

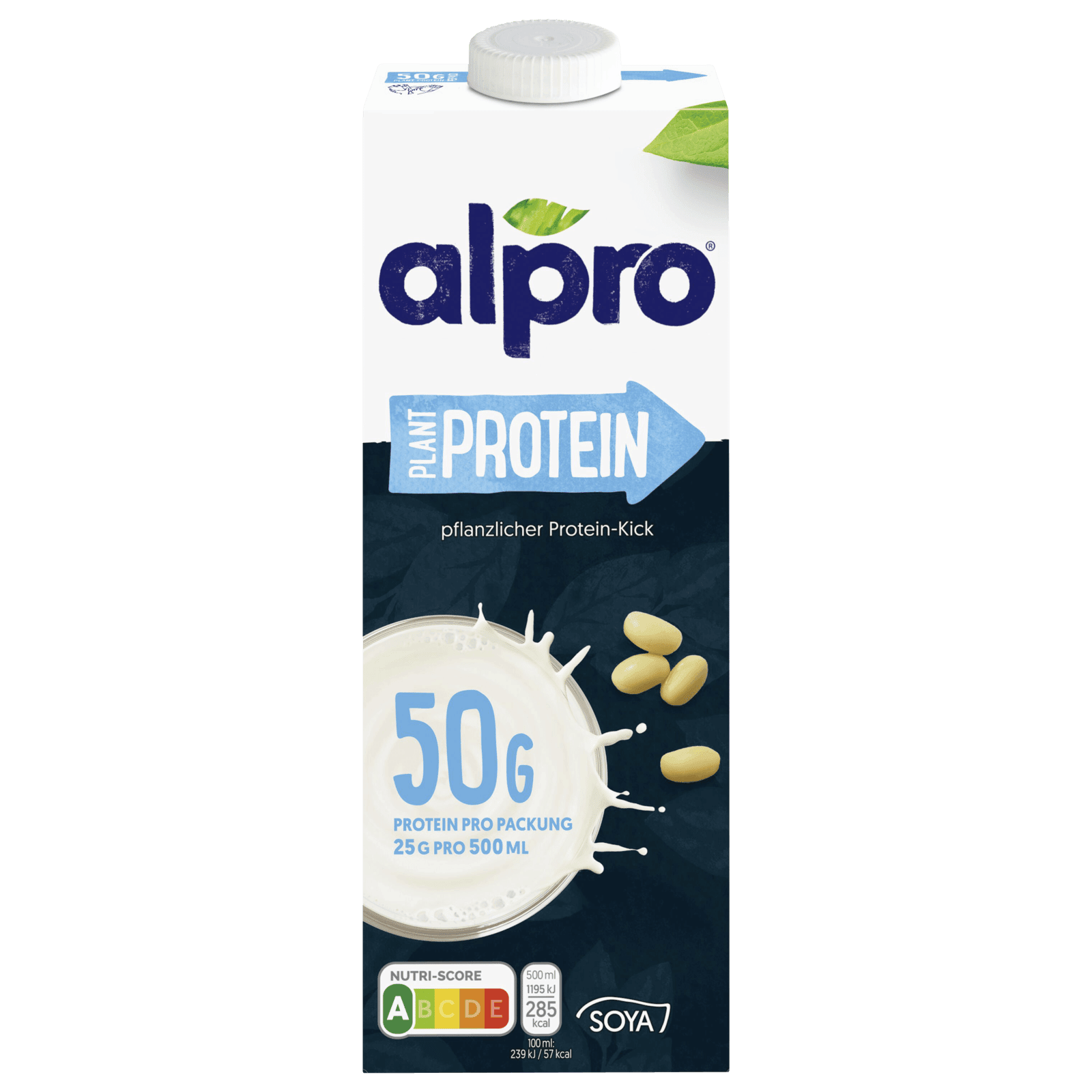

| Alpro Protein Soya Milk |  | 10 g protein per 200 ml serving Athlete’s endorsement on label |

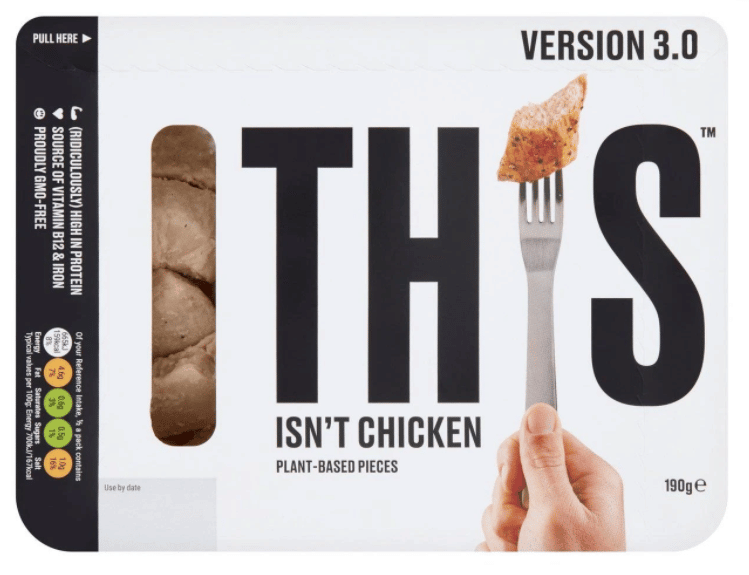

| This Isn’t Chicken |  | Fortified with B12 & Iron “Ridiculously high in protein” GMO free |

| Vivera Shawarma Kebab |  | 15% protein Fortified with B12 & iron |

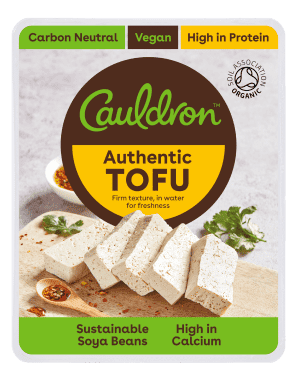

Cauldron Authentic Tofu Block |  | Organic High in calcium High in protein |

Hi Five Sri Lankan Vegan Gobi Curry |  | Organic High in calcium High in protein High in vitamins A, K, C, potassium, copper, and manganese Five of your “five a day” |

| Califia Farms Almond Milk |  | 50% more calcium than milk Soya free No added sugar |

All-rounders

Here are some examples of plant-based brands ticking all the boxes.

Tofurky’s Original Italian Sausage packaging foregrounds flavour, use, and health benefits:

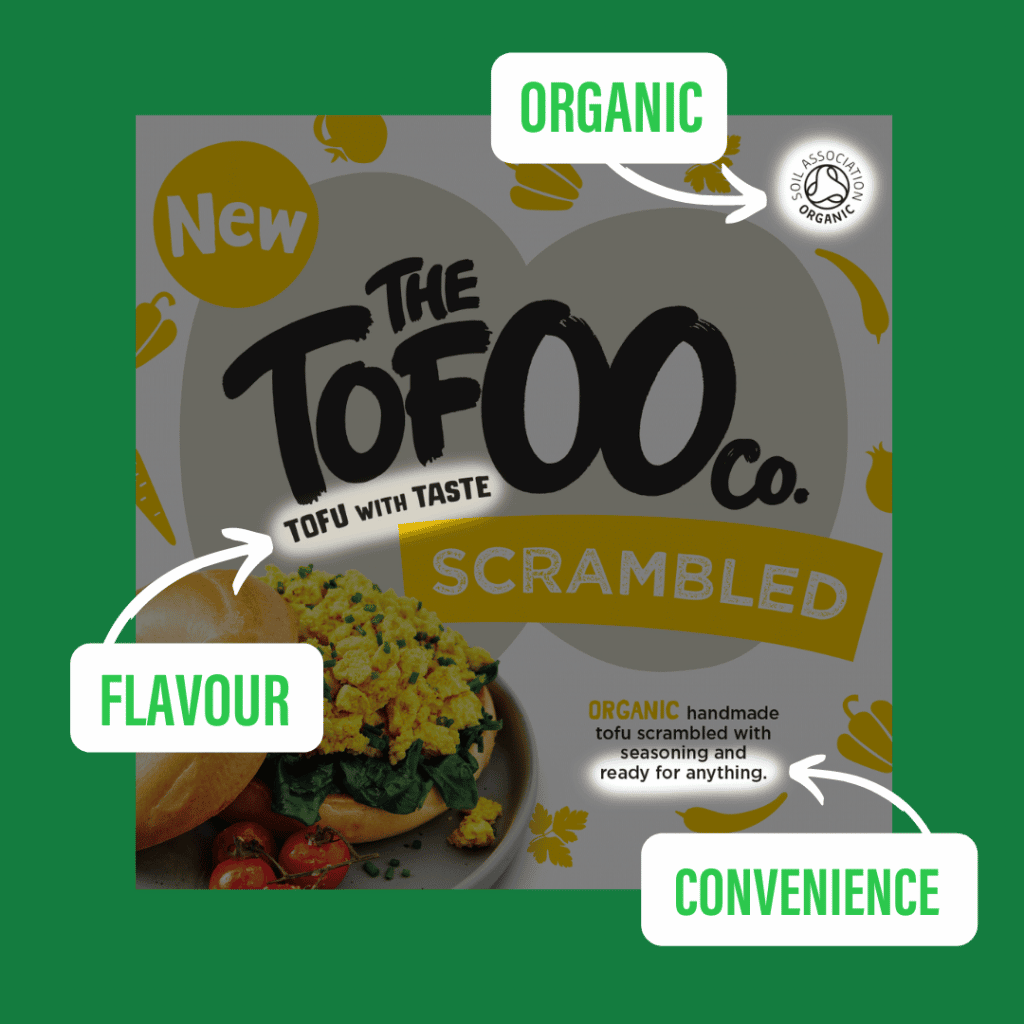

The Tofoo Co.’s Scrambled Tofu packaging covers all three of the top criteria for flexitarian shoppers. The packaging artwork subtly features accompanying vegetable items that complement the product.

The strapline “scrambled” is accompanied by a photo of the end product, showing us that it’s easy to use. This is further reinforced by the description, which tells you it’s pre-scrambled, and pre-seasoned. Short of literally spoon-feeding their consumer the meal, they’ve nailed it. This is a product designed with convenience, flavour, and health in one:

ProVeg works with you to identify your unique needs and enhance your reputation, revenue, and impact. Get detailed market insights from our free European Consumer Survey on Plant-based foods.

Bonus Case Study

A Plant-based face-plant

An alternative-protein producer partnered with some of Europe’s biggest food retailers. This was to be their biggest launch outside of the US. They had a great product and an impressive track record of reaching flexitarian customers in the US and the UK.

Their strategy was to persuade supermarkets to put the new plant-based burgers on the meat shelves in the chilled section.

To much surprise, the strategy – which had worked really well in the US and the UK – didn’t initially work in Europe. The initial failure produced two key negative consequences:

- The retailers are now wary of stocking any plant-based products outside of the vegan aisles. The great plant-based patties are once again confined to a place where less than 4% of shoppers go.

- The retailers involved made a loss. Two losses, in fact – first, owing to the branding oversights, the unsold fresh products had to be wasted – hitting the retailer’s bottom line. Second, this loss was in the context of an opportunity cost: the retailer had sacrificed sure-fire sales of animal meat for this failed experiment. It was awkward for everyone.

So what went wrong?

One of the affected retailers cited three weaknesses in the launch strategy:

- The brand’s ‘sexy’ messaging wasn’t appealing to Europeans.

La vie est un sommeil, l’amour en est le rêve (Life is a long sleep and love is its dream) ≠ I’m lovin’ it.

- The covers weren’t fully translated – and ingredients were on a sticker.

French consumers find English irritating. (I know it’s not your fault that Britain and France spent the middle ages fighting each other in wooden boats, but they did, so here we all are.)

- It was too expensive

We’re not targeting guilt-ridden vegans anymore. Mainstream flexitarians need a price incentive in order to try new products.

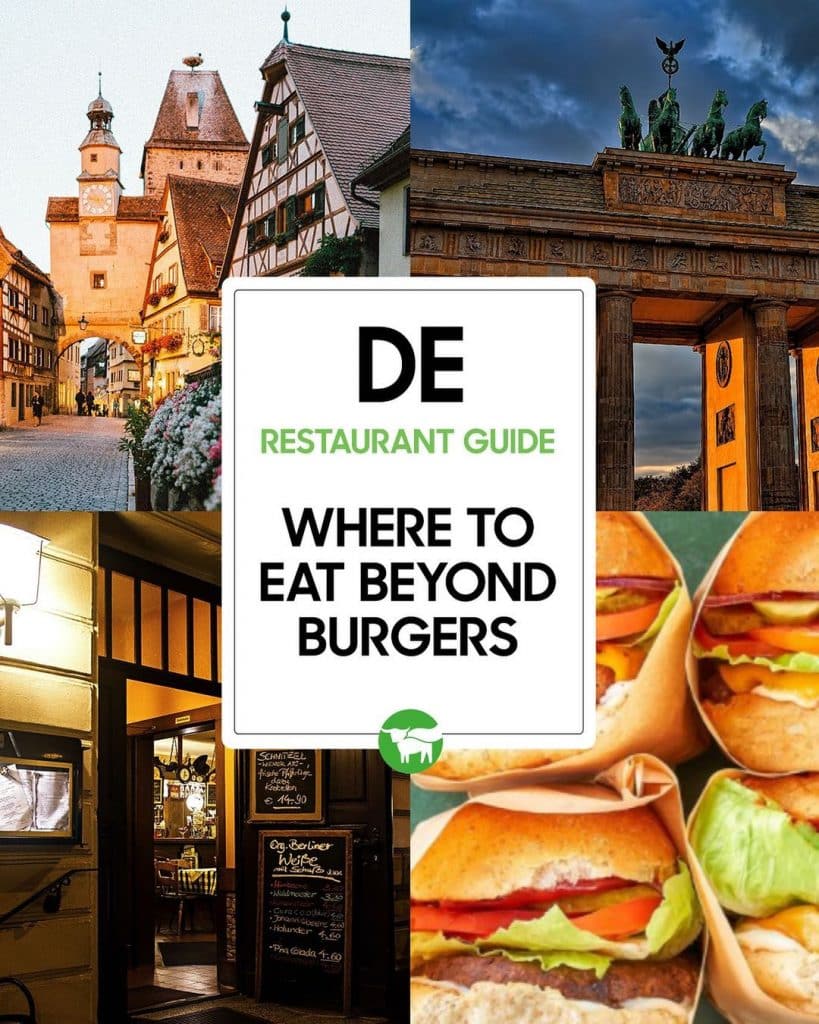

Snapshot: Beyond Meat’s progress in Europe

In 2020, Beyond Meat entered the European market. Their tailored marketing efforts are helping them to establish a loyal consumer base within each target country.

- Their packaging is translated into Dutch, French, and German.

- Manufacturing locally in Europe allows Beyond to leverage more sustainable local supply chains, and thus lower prices for consumers.

- Their dedicated EU Instagram channel features localised recipes and partnerships.

Beyond Meat also have country-specific guides on where consumers can try their products in local restaurants. This is a great way to drive retail demand.

Of course, the retail product still needs to be user-friendly. For more tips and case studies check out our guide: ‘Why you need convenience by design: how to make plant-based products easy for consumers’.

Looking for an expert review of your plant-based marketing strategy?

ProVeg helps food producers to develop and market plant-based products better. To optimise your plant-based marketing, check out more of our resources. If you have any questions, you can always reach us at [email protected]

References

- Smart Protein project (2021): Plant-based foods in Europe: How big is the market? Smart Protein Plant-based Food Sector Report. European Union’s Horizon 2020 research and innovation programme (No 862957). Available at https://smartproteinproject.eu/market-research/ (last accessed 01.10.2021).

- Parry, J and Szejda, K (2019): How to drive plant-based food purchasing. Key findings from a Mindlab study into implicit perceptions of the plant-based category. The Good Food Institute. Available at https://gfi.org/images/uploads/2019/10/GFI-Mindlab-Report-Implicit-Study_Strategic_Recommendations.pdf (last accessed 12.10.2021).

- White, K; Hardisty, D J and Habib, R (2019): The elusive Green Consumer. Harvard Business Review. Available at https://hbr.org/2019/07/the-elusive-green-consumer (last accessed 01.10.2021).

- Markets and Markets (2020): Plant-based meat market by source (soy, wheat, pea, & other sources), product (burger patties, strips & nuggets, sausages, meatballs, & other products), type (beef, chicken, pork, fish, & other types), process, and region – global forecast to 2025. Available at https://www.marketsandmarkets.com/Market-Reports/plant-based-meat-market-44922705.html?gclid=Cj0KCQjwktKFBhCkARIsAJeDT0i7hl3f7QfEd8JCisPynexMA_AJhs4yQn2zp_yfEwGfrIt0BzQ9tpgaAm9DEALw_wcB (last access 08.10.2021).

- ProVeg(2020): European consumer survey on plant-based foods. Available at https://corporate.proveg.com/wp-content/uploads/2022/02/PV_Consumer_Survey_Report_2020_030620.pdf

- Cited from Watson, E (2019): 48% of consumers buy plant-based and dairy milks, reveals IPSOS survey. Food Navigator. Available at https://www.foodnavigator-usa.com/Article/2019/01/24/48-of-consumers-buy-dairy-and-plant-based-milks-reveals-IPSOS-survey# (last accessed 01.10.2021).

- Gilbert, H (2019): Only a third of UK shoppers prioritise environmental concerns over price, says poll. The Grocer. Available at https://www.thegrocer.co.uk/sustainability-and-environment/only-a-third-of-uk-shoppers-prioritise-environmental-concerns-over-price-says-poll/598461.article (last accessed 01.10.2021).

- Michigan State University (2019): Michigan State University poll shows emerging food trends are more widely embraced by younger generations. Available at https://www.canr.msu.edu/news/michigan-state-university-poll-shows-emerging-food-trends-are-more-widely-embraced-by-younger-generations (last accessed 01.10.2021).

- Quotation cited from Burrows, D (2017): How brands can tap into the ‘flexitarian’ trend. MarketingWeek. Available at https://www.marketingweek.com/brands-effectively-tap-flexitarian-trend/ (last accessed 12.10.2021).

- Smith, A (2021): Move flexitarians to the (plant-based) meat of the matter. New Hope Network. Available at https://www.newhope.com/health-and-nutrition-research/move-flexitarians-plant-based-meat-matter (last accessed 12.10.2021).

- Understanding flexitarian preferences and needs is key to keeping them engaged with meat and dairy (2021). Agriculture and Horticulture Development Board. Available at https://ahdb.org.uk/news/consumer-insight-understanding-flexitarian-preferences-and-needs-is-key-to-keeping-them-engaged-with-meat-and-dairy (last accessed 01.10.2021).